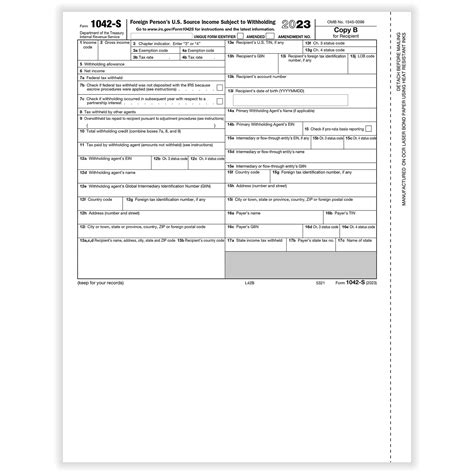

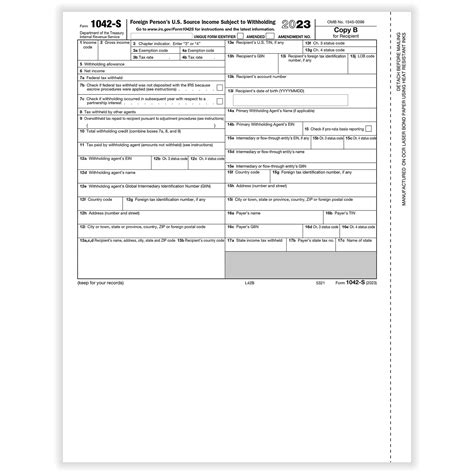

1042-s copy b c d|dscpa 1042 s : 2024-10-06 Attach only Copy A to Form 1042-T. Provide Copies B, C, and D to the recipient of the income. All copies must match the copy filed with the IRS. Any differences between the . Keep your Breitling timepiece running smoothly with a watch winder. Learn how to use a watch winder to properly wind your Breitling and ensure optimal .

0 · form 1042 s mary

1 · form 1042 s identification number

2 · form 1042 s dscpa

3 · dscpa 1042 s

4 · More

5 · 1042 s tax filing

6 · 1042 s identification code

7 · 1042 s form

8 · 1042 s filing instructions

• merk: breitling • model: navitimer 1884 triple date "limited edition" chronograaf - chronometer (cosc) gecertificeerd, in "uitstekende" staat. Als nieuw. Alle functies .

1042-s copy b c d*******Attach only Copy A to Form 1042-T. Provide Copies B, C, and D to the recipient of the income. All copies must match the copy filed with the IRS. Any differences between the .Information about Form 1042-S, Foreign Person's U.S. Source Income Subject to .About Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding. .

9 Use only if applying the escrow procedure for dormant accounts under Regulations .

portrait. Only one Form 1042-S may be submitted per page, regardless of orientation. Withholding agents that furnish a substitute Form 1042-S (Copy B, C, or D) to the recipient must furnish a separate substitute Form 1042-S for each type of payment of income (as determined by the income code in Box 1). Withholding agents are no longer

Only one 1042-S should be filed per calendar year. Copy A is due to the IRS and Copies B, C, and D to the recipient on March 15th of the year after the relevant payment was made. The withholding agent filing the 1042-S information returns keeps Copy E for their records. If you need more time to file Forms 1042-S, the IRS will grant an extension.I received a 1042-S form but only copies B, C and D? - Google AdSense Community.

Feb 12, 2024. --. 1. When you think about the year-end tax filings, 1099 and W-2 are the common forms that pop up in your mind. However, there are certain other crucial forms that you must be .

portrait. Only one Form 1042-S may be submitted per page, regardless of orientation. Withholding agents that furnish a substitute Form 1042-S (Copy B, C, or D) to the recipient must furnish a separate substitute Form 1042-S for each type of payment of income (as determined by the income code in box 1). Withholding agents are no

Form 1042-S is typically issued to recipients by 15 March of each year for the previous tax year’s income. This allows recipients to include the information on their US tax returns, which are due by 15 April in 2024. If you did not receive 1042-S form by this date, you should reach out to your payroll office to get them to issue you with one.1042-S Recipient Copy B. 1042-S Recipient Copy B. • Report all income and/or tax withheld for non-resident aliens and foreign corporations with United States income. • Recipient Copy B. • Laser cut sheets. • Printed with heat-resistant ink for use with most inkjet and laser printers. • Size: 8 1/2 x 11. • Ink Color: Black.1042-Sフォームについて. 1042-Sフォームとは、米国内国歳入庁(United States Internal Revenue Service - IRS)および支払先の個人または法人に対し、米国における源泉所得の報告に使用する書類です。. Shutterstockでは、 このフォームを2部作成します。. 1部は 寄 .

institution is required to file Forms 1042-S electronically if it is either required to file at least 10 information returns during the year or is a partnership with more than 100 partners. See Regulations section 301.6011-2. Income code 56. Income code 56 was added to the 2022 Form 1042-S to address section 871(m) transactionsdscpa 1042 sinstitution is required to file Forms 1042-S electronically if it is either required to file at least 10 information returns during the year or is a partnership with more than 100 partners. See Regulations section 301.6011-2. Income code 56. Income code 56 was added to the 2022 Form 1042-S to address section 871(m) transactions

9 Use only if applying the escrow procedure for dormant accounts under Regulations section 1.1471-4(b)(6). If tax was withheld and deposited under chapter 3, do not check box 7b (“tax not deposited with IRS pursuant to escrow procedure”). You must instead enter “3” in box 3 and complete box 3b.1042-s copy b c d dscpa 1042 s9 Use only if applying the escrow procedure for dormant accounts under Regulations section 1.1471-4(b)(6). If tax was withheld and deposited under chapter 3, do not check box 7b (“tax not deposited with IRS pursuant to escrow procedure”). You must instead enter “3” in box 3 and complete box 3b.

Code Changes for Form 1042-S: Income code 57 was added to the 2022 Form 1042-S for use by brokers (starting in 2023) to report amounts realized and related withholding from transfers of PTP interests for purposes that are subject to reporting on Form 1042-S under Regulations section 1.1461-1(c)(2)(i).; The 2023 Form 1042-S adds .

Components of Form 1042-S. Form 1042-S is a multi-page document. The form is repetitive because there are five copies labeled A thru E. Each copy goes to a different entity: Copy A — Internal Revenue Service. Copy B — Recipient. Copy C — Recipient (Attach to any Federal tax return you file)1042-s copy b c dComponents of Form 1042-S. Form 1042-S is a multi-page document. The form is repetitive because there are five copies labeled A thru E. Each copy goes to a different entity: Copy A — Internal Revenue Service. Copy B — Recipient. Copy C — Recipient (Attach to any Federal tax return you file)

Breitling Superocean kopen, Ref. A13320 modellen Dameshorloges - Gebruikt

1042-s copy b c d|dscpa 1042 s